Introduction

Are you looking to venture into the world of real estate investment but feeling overwhelmed by the complexities involved? Well, fear not! In this article, I’ll introduce you to a valuable asset that can help navigate the intricacies of this domain – the real estate investment advisor. Whether you’re a seasoned investor or just starting out, having a trusted advisor by your side can make a world of difference in your investment journey.

Definition of a Real Estate Investment Advisor

A real estate investment advisor is a qualified professional who specializes in providing expert guidance and advice to individuals or organizations looking to invest in real estate. These advisors possess an in-depth understanding of the market, trends, and strategies required to maximize the returns on your investments. They act as your strategic partner, leveraging their knowledge and experience to help you make informed decisions and achieve your investment goals.

Importance and Benefits of Hiring a Real Estate Investment Advisor

Investing in real estate can be a lucrative venture, but it comes with significant risks and challenges. This is where a real estate investment advisor becomes invaluable. By enlisting their services, you gain access to a wealth of expertise that can save you from costly mistakes and help you capitalize on profitable opportunities.

One of the primary benefits of having a real estate investment advisor is their ability to maximize your investment returns. These professionals possess a deep understanding of the market, allowing them to identify undervalued properties, negotiate favorable deals, and implement effective investment strategies tailored to your specific goals.

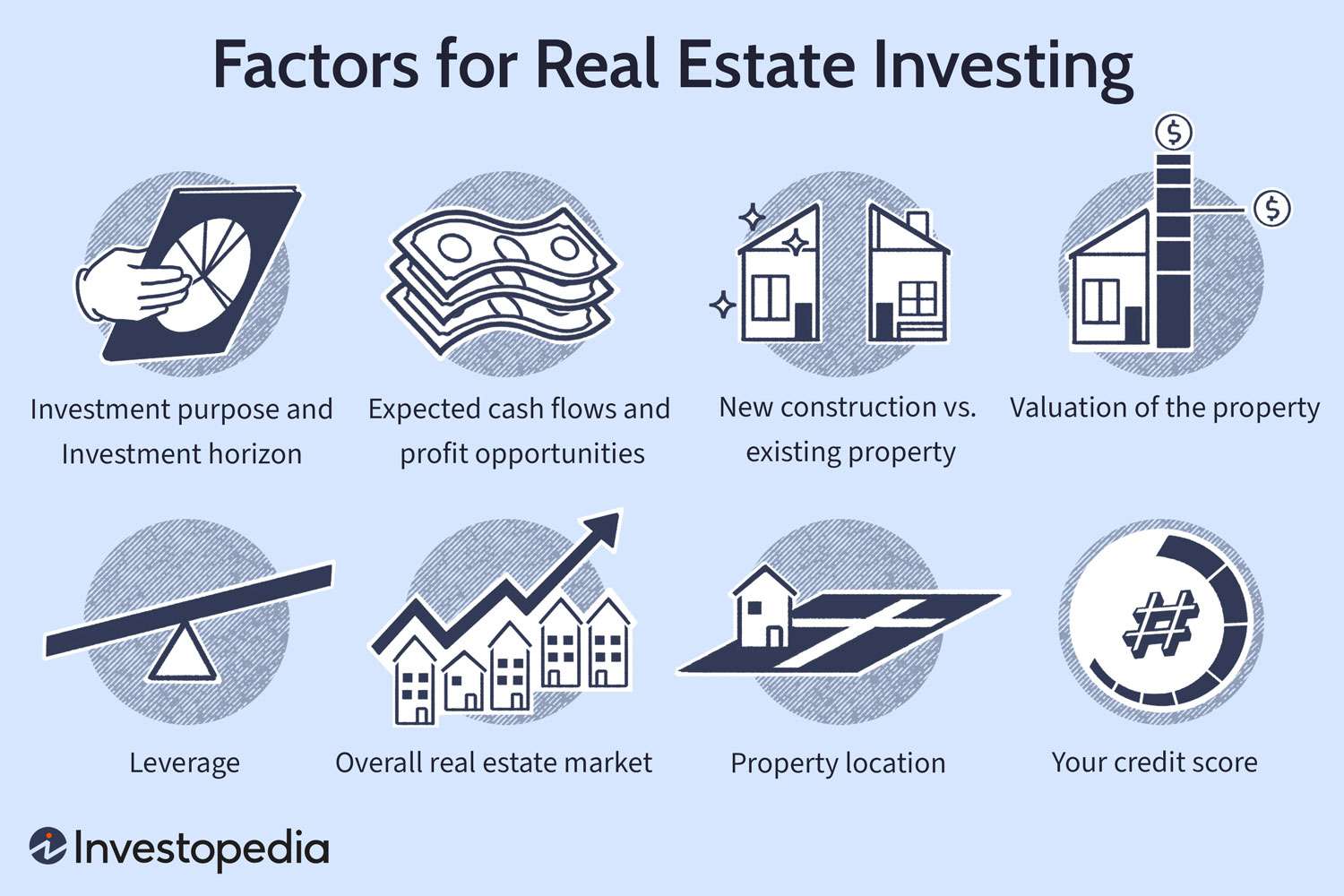

Moreover, real estate investment advisors provide you with peace of mind by minimizing risks. They conduct thorough research and analysis, taking into account various factors such as market conditions, property location, and financial feasibility. This ensures that you make well-informed decisions, avoiding common pitfalls and minimizing the potential for loss.

In conclusion, hiring a real estate investment advisor is a smart move for anyone looking to make sound investment decisions in the real estate market. Their expertise, guidance, and network of industry professionals can be the key to unlocking the full potential of your investments. So, don’t hesitate to seek professional assistance from a real estate investment advisor at investment.blognganhang.org and embark on a successful investment journey.

Qualifications of a Real Estate Investment Advisor

When it comes to selecting a real estate investment advisor, it’s essential to consider their qualifications. A qualified advisor possesses the necessary education, certifications, experience, and expertise to guide you effectively through the complexities of real estate investment. Let’s delve into the key qualifications you should look for when choosing your advisor.

Education and Certifications Required

A reputable real estate investment advisor should have a solid educational foundation in the field. Look for advisors who hold degrees in finance, business, economics, or a related discipline. These educational backgrounds equip them with the necessary knowledge of financial analysis, risk management, and investment strategies.

Furthermore, certifications play a crucial role in establishing an advisor’s credibility. Certifications such as the Certified Commercial Investment Member (CCIM) or the Chartered Financial Analyst (CFA) indicate that the advisor has undergone rigorous training and met industry standards. These certifications demonstrate their dedication to continuous learning and staying updated with the latest trends and practices in the real estate industry.

Experience in the Real Estate Industry

Alongside formal education, experience is an essential factor to consider when choosing a real estate investment advisor. Look for advisors with a proven track record in the industry. Experience provides them with valuable insights and the ability to navigate various market conditions successfully. Seasoned advisors have encountered different scenarios and can draw from their past experiences to guide you effectively.

Understanding of Market Trends and Analysis

A competent real estate investment advisor possesses a keen understanding of market trends and analysis. They stay up-to-date with market dynamics, including supply and demand, interest rates, and economic indicators. This knowledge allows them to identify emerging opportunities and make informed recommendations based on market conditions.

In conclusion, the qualifications of a real estate investment advisor play a pivotal role in their ability to guide you towards successful investments. Look for advisors with the right education, certifications, relevant experience, and a strong grasp of market trends. By selecting a qualified advisor, you can have confidence in their ability to navigate the real estate landscape and help you achieve your investment objectives.

Roles and Responsibilities of a Real Estate Investment Advisor

When you hire a real estate investment advisor, you gain a valuable partner who will take on various crucial roles and responsibilities to ensure your investment success. Let’s delve into their key functions:

Assisting clients in setting investment goals

The first step in any successful investment journey is setting clear and achievable goals. A real estate investment advisor will work closely with you to understand your financial objectives, risk tolerance, and desired timeline. By aligning your investment goals with market realities, they can help you create a strategic plan that maximizes your chances of success.

Conducting thorough research and analysis of potential properties

One of the core responsibilities of a real estate investment advisor is to conduct comprehensive research and analysis on potential investment properties. They go beyond surface-level information, delving into market trends, property evaluations, and neighborhood dynamics. By leveraging their expertise, they can identify properties with strong growth potential, rental yield, and long-term value appreciation.

Providing expert advice on property selection and investment strategies

With a deep understanding of the real estate market and investment strategies, a real estate investment advisor acts as your trusted advisor. They will provide you with expert advice on property selection, taking into consideration factors such as location, market demand, and potential risks. Moreover, they will guide you in developing investment strategies that align with your goals, whether it’s buy and hold, fix and flip, or rental properties.

Monitoring and evaluating investment performance

Once your investments are up and running, a real estate investment advisor plays a crucial role in monitoring and evaluating their performance. They analyze key metrics such as cash flow, return on investment, and occupancy rates to ensure your investments are on track. If adjustments are needed, they provide actionable insights and recommendations to optimize your portfolio’s performance.

Assisting with property acquisition and management

Navigating the complex process of property acquisition can be daunting, especially for novice investors. A real estate investment advisor can guide you through each step, from property selection and due diligence to negotiations and closing deals. Additionally, they can help you with property management, ensuring smooth operations, tenant screening, and maintenance to maximize your returns.

In summary, a real estate investment advisor takes on multifaceted roles to help you achieve your investment goals. From setting objectives to conducting thorough research, providing expert advice, monitoring performance, and assisting with property acquisition and management, their expertise is indispensable in the complex world of real estate investment.

Benefits of Hiring a Real Estate Investment Advisor

Investing in real estate can be a complex and time-consuming endeavor. However, by enlisting the services of a real estate investment advisor, you gain access to a multitude of benefits that can significantly enhance your investment journey.

Maximizing Investment Returns

One of the primary advantages of hiring a real estate investment advisor is their ability to maximize your investment returns. These advisors possess extensive knowledge and experience in the real estate market, allowing them to identify lucrative opportunities that align with your investment goals. They conduct in-depth research and analysis, considering factors such as market trends, property appreciation potential, and rental income prospects. With their expert guidance, you can make informed decisions that have the potential to yield higher returns on your investments.

Minimizing Risks and Avoiding Common Pitfalls

Real estate investments come with inherent risks, and without proper guidance, you may fall victim to common pitfalls. A real estate investment advisor helps mitigate these risks by conducting thorough due diligence on potential properties. They assess factors such as property condition, legal issues, and market stability to ensure you invest in properties with minimal risk exposure. By leveraging their expertise, you can navigate around potential obstacles and make informed decisions that protect your investment capital.

Access to a Network of Industry Professionals

When you hire a real estate investment advisor, you gain access to their extensive network of industry professionals. These connections include real estate agents, property managers, contractors, and lenders. This network can prove invaluable when it comes to property acquisition, management, and financing. By tapping into their trusted connections, you can streamline the investment process and access resources that may not be readily available to individual investors.

Saving Time and Effort in Property Selection and Management

Searching for the right investment property can be a time-consuming task. A real estate investment advisor takes on this burden for you, utilizing their market knowledge and expertise to identify properties that meet your investment criteria. They conduct comprehensive property evaluations, saving you valuable time and effort. Additionally, these advisors can assist with property management, handling tasks such as tenant screening, rent collection, and maintenance coordination. By delegating these responsibilities, you can focus on other aspects of your life while reaping the benefits of a well-managed investment portfolio.

In summary, hiring a real estate investment advisor offers a range of benefits, including maximizing investment returns, minimizing risks, accessing a network of industry professionals, and saving time and effort. By collaborating with a trusted advisor, you can navigate the real estate market with confidence and achieve your investment goals more effectively.

How to Choose the Right Real Estate Investment Advisor

When it comes to choosing the right real estate investment advisor, you want to ensure that you find someone who aligns with your investment goals and can deliver the expertise you need. Here are some essential steps to help you make an informed decision:

Researching and Evaluating Credentials and Track Record

Start by conducting thorough research on potential real estate investment advisors. Look for professionals who have the necessary qualifications, such as relevant certifications and education in real estate or finance. Additionally, consider their track record in the industry. Look for testimonials, case studies, or reviews from previous clients to gauge their performance and success rate.

Interviewing Potential Advisors to Assess Their Expertise and Compatibility

Once you have shortlisted a few potential advisors, schedule interviews or consultations with them. Treat these interactions as an opportunity to assess their expertise and determine if they are a good fit for your investment needs. Ask them about their experience, investment strategies, and their understanding of the current market trends. Pay attention to their communication style, responsiveness, and whether they actively listen to your goals and concerns. Building a strong rapport and feeling comfortable with your advisor is crucial for a successful partnership.

Checking for Any Conflicts of Interest

It’s important to ensure that your real estate investment advisor has your best interests at heart. Inquire about any potential conflicts of interest they may have, such as representing both buyers and sellers simultaneously. Transparency and trust are key in this relationship, so ensure that your advisor is fully committed to advocating for your investment objectives.

By following these steps, you can make an informed decision and select the right real estate investment advisor who will guide you towards achieving your investment goals. Remember, investing in real estate is a significant financial decision, and having the right advisor by your side can make all the difference.

Conclusion

In a realm as dynamic and complex as real estate investment, having a skilled real estate investment advisor by your side is a game-changer. Their expertise, authority, and trustworthiness can guide you towards making sound investment decisions, maximizing your returns, and minimizing risks.

Throughout this article, we have explored the definition and significance of a real estate investment advisor. These professionals possess the knowledge and experience necessary to navigate the intricate real estate market, identify lucrative opportunities, and help you achieve your investment goals.

By enlisting the assistance of a real estate investment advisor, you gain access to their extensive network of industry professionals. This network can prove invaluable when it comes to acquiring properties, managing investments, and staying up-to-date with the latest market trends.

When it comes to choosing the right advisor, be sure to conduct thorough research and evaluate their credentials and track record. Interview potential advisors to assess their expertise and determine if they align with your investment objectives. Remember to check for any conflicts of interest to ensure that their advice is unbiased and in your best interest.