Have you ever wondered what happens to the stock market when the closing bell rings? While most investors call it a day, a whole new world of trading emerges – after-hours trading. In this article, we’ll delve into the fascinating realm of Dow after-hours trading and explore why monitoring it can be a game-changer for savvy investors like you.

Introduction

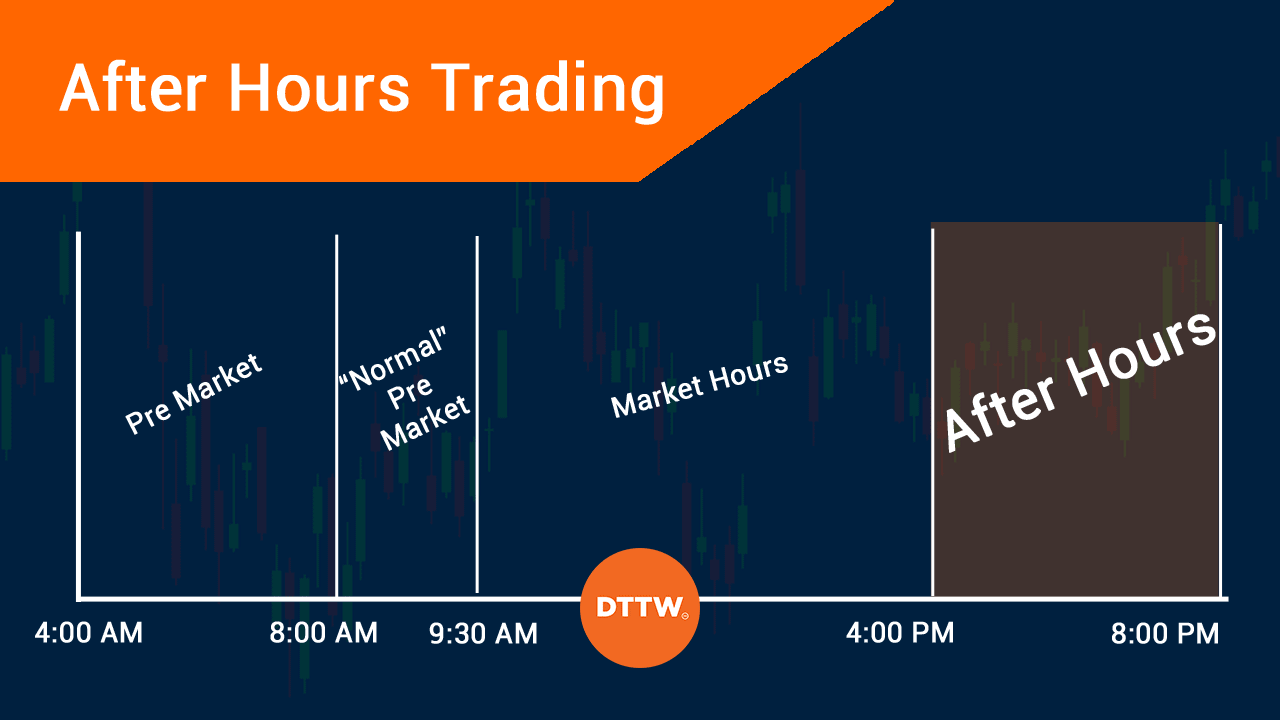

At its core, after-hours trading refers to the buying and selling of stocks outside the regular trading hours, which typically run from 9:30 am to 4:00 pm Eastern Time. But why does after-hours trading matter, and why should you pay attention to it, especially when it comes to the Dow?

Understanding the significance of after-hours trading is crucial because it provides insights into how the market may react to news and events overnight. It’s like peering through a keyhole into the future, allowing you to anticipate market trends and gain a competitive edge. By monitoring Dow after-hours trading, you gain a head start on potential opportunities and risks that may unfold when the market reopens the following day.

Moreover, after-hours trading is not limited to a select few investors. Thanks to technological advancements, individual traders like you can now participate in after-hours trading and potentially capitalize on market movements that occur outside regular trading hours. It opens up a world of possibilities, but only if you know how to navigate it wisely.

In the upcoming sections, we’ll unravel the intricacies of Dow after-hours trading and equip you with the knowledge and strategies needed to make the most of this unique market phenomenon. So, fasten your seatbelts as we embark on this exciting journey together!

Stay tuned for Section II, where we’ll dive deep into the intricacies of understanding Dow after-hours trading.

Understanding Dow After-Hours Trading

Definition and Concept of Dow After-Hours Trading

Dow after-hours trading refers to the buying and selling of securities linked to the Dow Jones Industrial Average (DJIA) outside the standard trading hours. The DJIA represents 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ Stock Market. During after-hours trading, investors can continue trading these stocks, enabling them to react to news and events that occur after the closing bell.

How it Differs from Regular Trading Hours

After-hours trading differs from regular trading hours in several ways. Firstly, after-hours trading has extended hours, allowing investors to trade from 4:00 pm to 8:00 pm Eastern Time, and sometimes even beyond. This extended window provides opportunities to act on new information before the market officially reopens the next day.

Secondly, after-hours trading generally experiences lower trading volumes compared to regular hours. This lower liquidity may lead to higher bid-ask spreads, making it crucial for traders to use limit orders to ensure they execute trades at desired price levels.

Lastly, after-hours trading is subject to different rules and regulations. For instance, certain order types, such as stop-loss and stop-limit orders, may not be available during after-hours trading. It’s essential to familiarize yourself with the specific guidelines of your brokerage platform to make informed trading decisions.

Factors Influencing After-Hours Trading in the Dow

Several factors can influence after-hours trading in the Dow. Breaking news, earnings announcements, economic indicators, and geopolitical events can all impact the market sentiment during after-hours trading. Positive or negative developments can cause stock prices to fluctuate, presenting opportunities and risks for investors.

Additionally, after-hours trading can be influenced by the performance of international markets. News from overseas markets, such as Asia or Europe, can have a ripple effect on the Dow during extended trading hours. Understanding these external influences is crucial for interpreting after-hours trading activity accurately.

In Section III, we’ll explore the advantages and disadvantages of Dow after-hours trading, providing you with valuable insights to navigate this unique market phenomenon.

Advantages and Disadvantages of Dow After-Hours Trading

Benefits of Participating in After-Hours Trading

When it comes to after-hours trading in the Dow, there are several advantages that can entice investors like you to explore this unique market opportunity. Here are some key benefits worth considering:

1. Extended Trading Hours: After-hours trading allows you to extend your trading day beyond regular market hours. This flexibility is particularly advantageous for those who have busy schedules during the day or for international investors who operate in different time zones. You can seize potential opportunities and act on news that may impact the market before regular trading hours commence.

2. Reacting to Earnings Reports and News: After-hours trading provides a platform to react swiftly to earnings reports and significant news releases that occur outside regular trading hours. This can be crucial as market-moving events often happen after the market closes. By participating in after-hours trading, you can capitalize on the initial market reaction, potentially gaining an edge over other traders who have to wait until the next trading session.

3. Potential for Enhanced Liquidity: While after-hours trading volumes may be lower compared to regular trading hours, there is still a considerable level of liquidity available. This can be beneficial for traders looking to buy or sell larger positions without significantly impacting the stock price. Moreover, increased liquidity can lead to narrower bid-ask spreads, reducing transaction costs.

Risks and Challenges Associated with After-Hours Trading

While after-hours trading offers exciting opportunities, it’s important to be aware of the risks and challenges that come with it. Here are a few key considerations:

1. Higher Volatility and Reduced Liquidity: The after-hours market tends to be less liquid than regular trading hours, which can result in wider bid-ask spreads and increased price volatility. This can make it more challenging to execute trades at desired prices and expose investors to potential price fluctuations.

2. Limited Access to Information: During after-hours trading, access to real-time news and information may be limited, leaving traders at a disadvantage compared to regular trading hours. This lack of information can make it challenging to assess market sentiment accurately and react appropriately to changing conditions.

Strategies to Mitigate Risks in After-Hours Trading

To navigate the risks associated with after-hours trading in the Dow, it’s crucial to employ effective risk management strategies. Here are some recommendations to mitigate potential pitfalls:

1. Set Clear Trading Goals and Strategies: Before engaging in after-hours trading, define your objectives and establish a well-thought-out trading plan. Set specific entry and exit points, determine risk tolerance, and stick to your strategy to avoid impulsive decisions driven by market volatility.

2. Utilize Limit Orders: To manage price volatility and ensure execution at desired prices, consider using limit orders rather than market orders. By setting a specific price at which you are willing to buy or sell, you can maintain more control over your trades.

3. Stay Informed and Monitor News: While access to real-time news may be limited during after-hours trading, it’s essential to stay informed about any significant developments that may impact the market. Utilize reliable news sources and tools that provide after-hours market updates to make informed trading decisions.

By understanding the advantages, risks, and implementing effective risk management strategies, you can make the most of Dow after-hours trading while minimizing potential downsides. In the next section, we’ll explore tips for effectively monitoring Dow after-hours trading to stay ahead of the game.

Stay tuned for Section IV, where we’ll uncover valuable tips for monitoring Dow after-hours trading like a pro.

Tips for Monitoring Dow After-Hours Trading

When it comes to monitoring Dow after-hours trading, having the right tools and knowledge is essential. In this section, we will explore some valuable tips to help you stay ahead of the game and make informed decisions during this unique trading period.

Reliable Sources for Tracking Dow After-Hours Trading

To effectively monitor Dow after-hours trading, it’s crucial to rely on trustworthy and real-time sources of information. Here are a few reliable sources to consider:

- Financial News Websites: Reputable financial news platforms, such as Bloomberg, CNBC, or Reuters, provide up-to-date information on after-hours trading activity in the Dow. These websites offer comprehensive insights and analysis to help you understand market trends and make informed decisions.

- Brokerage Platforms: Many online brokerage platforms now provide after-hours trading data and tools for their clients. Check if your brokerage offers this feature, as it can be a convenient and reliable source for monitoring Dow after-hours trading.

- Market Data Providers: Market data providers like Nasdaq or Dow Jones offer real-time after-hours trading data. Subscribing to their services can give you access to accurate and timely information on Dow after-hours trading activity.

Key Indicators and Metrics to Consider

Monitoring key indicators and metrics during after-hours trading can provide valuable insights into market sentiment and potential price movements. Consider the following indicators:

- Volume: Pay attention to the volume of shares traded during after-hours sessions. Higher volume can indicate increased market activity and potential price volatility.

- Price Movements: Analyze any significant price movements of individual stocks or the Dow futures index during after-hours trading. Tracking these movements can help you anticipate potential trends and market reactions.

- Earnings Announcements and News: Stay informed about any earnings announcements or breaking news related to Dow components or the overall market. Such information can significantly impact after-hours trading and subsequent regular trading hours.

Analyzing Market Sentiment During After-Hours Trading

During after-hours trading, market sentiment can play a crucial role in shaping future market trends. Here’s how you can analyze market sentiment effectively:

- Social Media Monitoring: Keep an eye on social media platforms like Twitter or Stocktwits, where traders often share their sentiment and opinions on after-hours trading. However, exercise caution and consider multiple sources before making any trading decisions based on social media sentiment.

- Pre-Market Trading: Pay attention to pre-market trading, which occurs before regular trading hours. Pre-market trading can provide insights into how the market may react during after-hours trading and the subsequent trading day.

By utilizing reliable sources, tracking key indicators, and analyzing market sentiment, you can gain a deeper understanding of Dow after-hours trading and make more informed investment decisions.

Stay tuned for Section V, where we’ll explore the impact of Dow after-hours trading on regular trading hours.

Impact of Dow After-Hours Trading on Regular Trading Hours

How does after-hours trading affect the opening of regular trading?

After-hours trading in the Dow can significantly impact the opening of regular trading hours. As the after-hours session provides a glimpse into market sentiment and potential price movements, it sets the stage for the next day’s trading activity. If significant developments occur during after-hours trading, they can create a ripple effect that carries into the regular trading session.

Potential market reactions to after-hours trading events

Events that unfold during after-hours trading can trigger various market reactions when regular trading hours commence. Positive news, such as better-than-expected earnings or a significant corporate announcement, can lead to a surge in buying interest and a bullish sentiment at the opening bell. Conversely, negative news or disappointing earnings reports can spark selling pressure and a bearish sentiment, potentially impacting stock prices.

It’s crucial to note that after-hours trading volumes are typically lower than those during regular trading hours. Therefore, the impact of after-hours events may be magnified or diluted once regular trading resumes, depending on the level of participation and sentiment during the after-hours session.

Examples of notable after-hours trading influencing regular trading

Over the years, several instances have showcased the influence of after-hours trading on regular trading hours. One notable example is when a company releases its earnings report after the market closes. If the report exceeds expectations, the stock may experience a significant surge in after-hours trading, setting the stage for a positive opening the next day. On the other hand, if the report disappoints, the stock may witness a sharp decline during after-hours trading, potentially leading to a bearish start the following day.

Another example is when market-moving news, such as geopolitical events or economic data, is released outside regular trading hours. These events can create substantial volatility and impact market sentiment, leading to significant price movements when regular trading resumes.

By keeping a close eye on after-hours trading events and understanding their potential impact, you can position yourself to capitalize on opportunities and mitigate risks when regular trading hours begin.

Stay tuned for Section VI, where we’ll conclude our exploration of Dow after-hours trading and summarize the key takeaways for investors and traders.

Conclusion

In conclusion, keeping a close eye on Dow after-hours trading can be the key to unlocking hidden opportunities in the stock market. By understanding the nuances and significance of after-hours trading, you gain a valuable edge over other investors. Through after-hours trading, you can gauge market sentiment, anticipate potential price movements, and make informed decisions for your investment portfolio.

Remember, the world of after-hours trading is not without its risks. It’s essential to approach it with caution and implement appropriate risk management strategies. Utilize reliable sources, monitor key indicators, and analyze market sentiment to make calculated moves during after-hours trading.

At exchange.blognganhang.org, we prioritize providing you with the latest insights and tools to navigate the dynamic world of stock trading. We hope this article has shed light on the importance of monitoring Dow after-hours trading and equipped you with the knowledge to make informed investment decisions.

As you embark on your trading journey, never underestimate the power of after-hours trading. By embracing this lesser-known facet of the market, you position yourself to capitalize on opportunities that others may overlook. Stay vigilant, stay informed, and let exchange.blognganhang.org be your guiding light in the ever-evolving world of Dow after-hours trading.

Thank you for joining us on this enlightening exploration of Dow after-hours trading. May your investments soar to new heights!